Thinking

Make love,

not war

There seems nothing odd about the strategy of beating the competition. It is how leaders and managers were trained over decades and how many consultancies still work today. To be fit for the future, however, we advise to rethink this inherited paradigm.

Setting the sole focus on competition creates sameness. The customer criteria for products or services without a differentiator is price. Consequentially, without a differentiator, you are entering a price-war, from which neither you, nor your competitor will benefit.

Approaches to differentiate are often argued to be of technological nature, or to be found in logistics, or production advantages, to name a few. And while these are without doubt excellent advantages to possess, they are not sustainable over time. Competition will eventually catch-up. The only question is when. And then we´re back to sameness and a price-war.

Woah. Hold on a second, you might say. You forgot that I do have a brand as a differentiator. Yes. But so does your competitor. Let´s be clear: we´re not diminishing the value of brands, but if we follow that line of thought down to the end, the conclusion is somewhat bleak: the make or break of brands today ultimately depends on their ability to deliver on their promises, with social media and the wider internet being the judge for all stakeholders in a company´s ecosystem.

All the above mentioned must undoubtedly be led and managed to excellence, but none of it differentiates us in a sustainable way for customers. To achieve true differentiation requires a strategic mindshift from competition and brand building focus towards Customer Engagement as a priority. That is why Customer Engagement is the central pillar of the Futuriser Method.

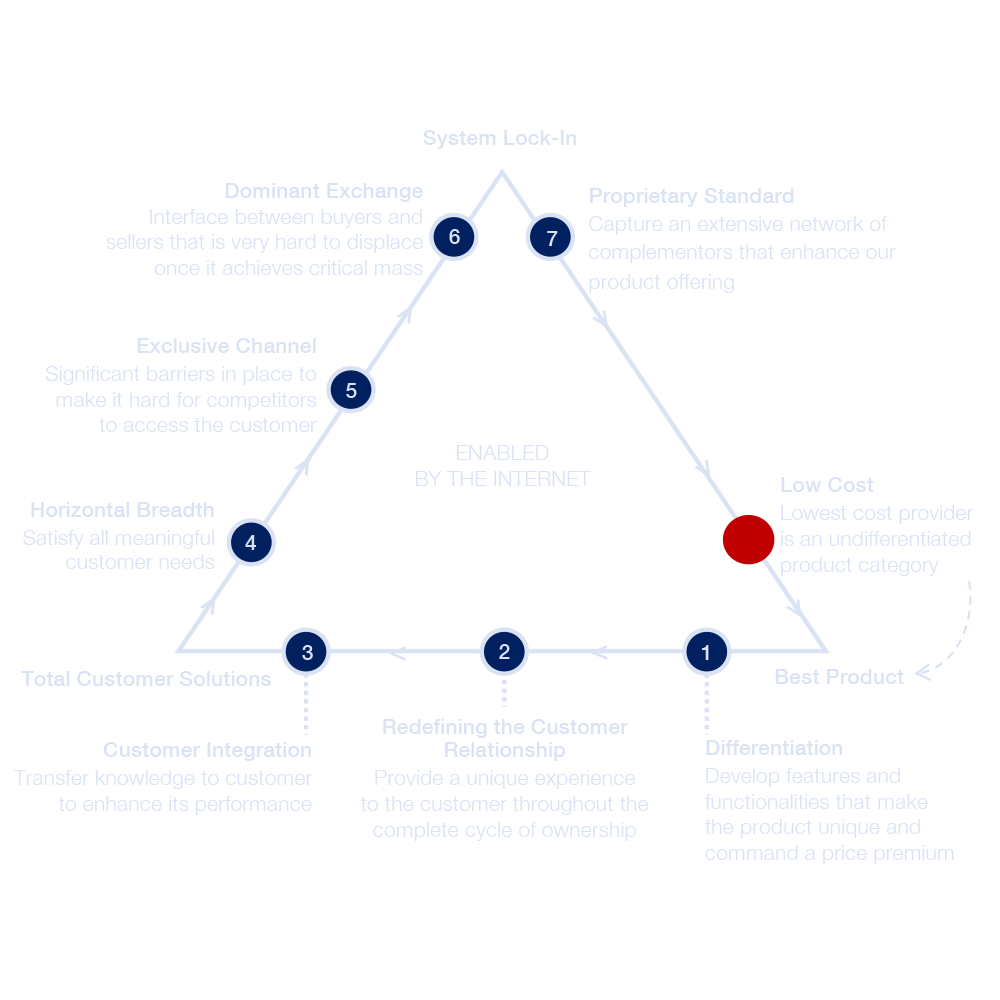

Let´s think about it. Digital and the internet enable us to create strategy one customer at a time. Technology here is a means to achieve unbreakable customer bonding. We can now be so close to our customers and our ecosystem that we truly understand their individual needs and can adjust and extend our products and services accordingly. The winning strategy has shifted from competition centric to customer centric.

Strategy making shifted from war to love.

Make love

Not war

Digital and the internet allow us to create an unbreakable customer bonding, alleviating the price trap through customer lock-in. Whoever does this best, wins trough differentiation, based on customer needs.

There are different types of customer lock-ins, which have been extensively researched and described by the MIT, Sloan School, Professor for Technological Innovation, Entrepreneurship and Strategic Management, Arnoldo Hax. We embrace his Delta model and depict an interpretation of it here. The laurels belong to him, not us. We´re only setting this into practice for you to avoid price-wars by achieving sustainable differentiation with customers and your ecosystem in the future.

Let us know if you would like to reset your strategic priorities. We would love to work with you!

| Learn more |

| Learn more |

Innovative business models

How smart companies conquer future blindness

Sven Göth is the founder and CEO of Futuriser GmbH, a future consulting firm based in Hanover. In this interview with Themenschmiede, he outlines the mindset and methods for the business models of the day after tomorrow.

Mr. Göth, why do many medium-sized companies find it so difficult to look strategically into the future?

Their focus is usually on incremental development in which they are excellent. They opti-mize their processes, their KPIs and finances and respond to the respective challenges of their markets. Why are they often blind to the impact factors that could be relevant for their business in a period of five to ten years? I think they do not have the capacity for that in the first place. Managers and employees are completely occupied with the operational business and short- to medium-term goals. But at the same time, it would be just as important to keep an eye on the long-term perspective and to play it out again and again in probabilities, scenarios and periodizations. After all, we live in a world that has become incredibly im-plausible. Secondly, quite a few executives find it difficult to think beyond the horizon. They are not trained to do so. When it comes to expansion through acquisitions, many companies reflexively strengthen their core business and buy competitors. They are familiar with the competitors’ business models, which they can calculate up and down. The lucrative start-up, on the other hand, which could have been acquired for half the price and growth rates of up to 300 percent or more, never turned up on their radar.

Futurologist Jamais Cascio describes the world as brizzle, anxious, non-linear and incom-prehensible (BANI). How can companies still set a clear course in these confusing times?

Companies must try to gain a resilient idea of which key drivers will influence their business model, their customer engagement, and their Ways of Work. This is not about analyzing every megatrend, but about the big picture. It is obvious, for example, that customer rela-tionships will continue to change due to demographic changes and the increased im-portance of social media. Undoubtedly, collaboration in companies is influenced by decen-tralized collaboration, new leadership models, and the shortage of staff and skilled workers. Ultimately companies should scrutinize their business in four fields of action: digitalization, demographic change, sustainability and geopolitics.

Is it a deceptive impression, or is the geopolitical aspect still clearly neglected?

The topic actually deserves more attention. Geopolitics has become enormously important this decade. Think of the Brexit in January 2020, or the problems in supply chains as a result of the Corona pandemic. The Russian attack on Ukraine has caused untold suffering as well as an energy and economic crisis, and most Western companies have withdrawn from the Russian market. At the same time, the battle for global dominance between the U.S. and China is coming to a head. The competition of systems and values is in full swing and has serious effects on market access and trade agreements. It is essential to deal with these developments and to evaluate the opportunities and risks for one’s own business.

Nowadays, companies have access to information in abundance. How can it be condensed into a strategy?

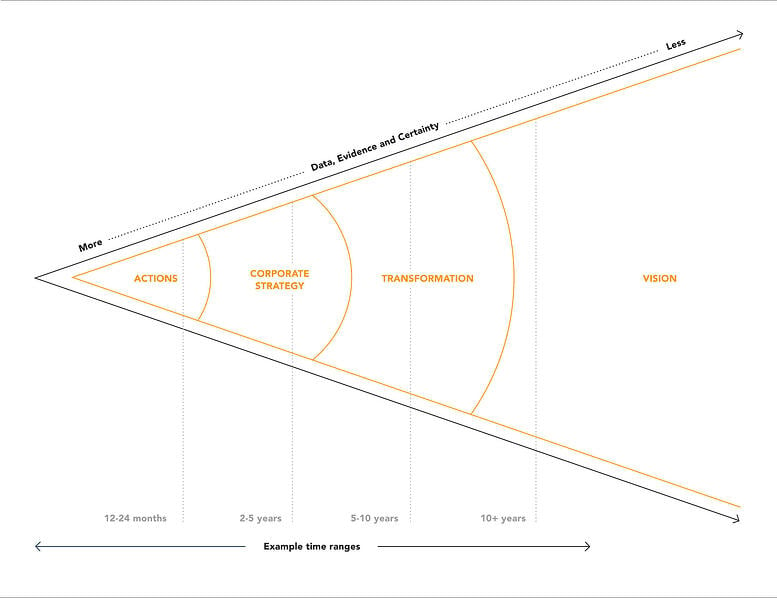

At Futuriser, we have developed a prototypical innovation process that may serve as a mod-el and inspiration for medium-sized companies in particular. Our starting point is called framing, where we learn to understand the pressure for change and the key drivers in the market. We conduct structured interviews and organize workshops within the companies, while we gather external information in parallel, for example through intensive research or discussions in our Expert Network. On this basis, we can use techniques such as vision map-ping to draw a comprehensible development path into the next ten or twelve years.

Figure 1: Vision Map – Schematic of a vision map with a time horizon of ten years and more.

Source: FUTURISER GmbH

Graphic creation: Allfoye Managementberatung GmbH with the support of Veit Quandt.

How does the collected knowledge become a business model?

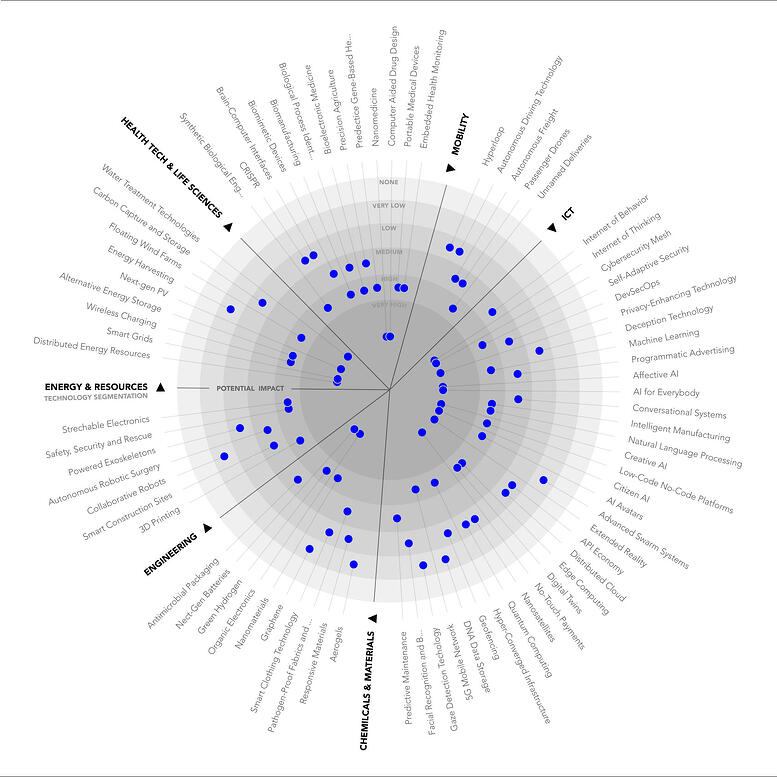

We are convinced that an approach to modeling that is both research-based and associative leads to valid results. For us, associative means bringing together the knowledge, experi-ence and expectations within the company, our team and our network to form an overall picture and deriving designs for new business models from this. Further research and expert interviews in our ecosystem of companies, futurologists, technology experts and consultan-cies, which we have built up over many years, are just as much a part of this as AI-based trend radars, such as those produced by our partner Itonics from Nuremberg. This allows technology trends and market potential to be identified with software support and evaluated in the context of the respective company. There are so many interesting innovations and developments out there. Most companies can’t monitor them on their own. And they don’t even notice the quiet signals that herald a disruption.

Figure 2: Data and AI-based radars reveal technology trends, drivers of disruption and market potential. The software structures and visualizes complex information from a variety of sources and enables individual evaluations.

Source: FUTURISER GmbH

Graphic creation: Allfoye Managementberatung GmbH with the support of Veit Quandt.

If companies have too little capacity to rethink the future anyway, how are they supposed to implement long-term and elaborate innovation projects?

They need to think carefully about which plans they want to pursue within their organization and which will be realized with external resources. We call this phase planning. Many busi-ness model innovations involve investments in digital technologies, and every company must be honest with itself about what it can and cannot achieve. Jumping headlong into a project generates additional costs in the best case and causes innovations to fail in the worst case. The way to avoid this trap is to make an informed decision: Partnership? Do it yourself? Buy in? In the banking and insurance sector, for example, the current focus is on automating processes with the help of artificial intelligence. When applications, orders, etc. are processed without humans being involved, this is known as dark processing. This is an elementary important topic that one of our customers also had to deal with.

Do it yourself? No. Make an acquisition? Too expensive. Strategic partnership? That was the solution – a joint venture with a leading technology company. And at the same time, a new development path was created in our own organization, because as a company you naturally learn a lot in such a cooperation.

In the end it’s all about implementing the right idea…

Exactly. When it comes to executing business model innovations, nothing less than the fu-ture of the company is at stake. In some industries, such as mechanical engineering, there is no shortage of ideas and role models. As-a-service models, platform economies, subscrip-tions, billing by volume, number of units or other performance data – the question is always: How do I make a business case out of this, how can this be calculated? How do I translate a traditional business into a new business model, possibly even with the same machine, but more intelligently and with a higher service level? So the exciting part is that, in our experi-ence, two-thirds of the major drivers of business model development among companies in a given industry are identical. That’s why it’s rarely individual companies that offer a target for disruption, but usually entire sectors of the economy. The art is to look for differentiation in the remaining third, in the exclusive characteristics of culture, product range, supply chains, value creation patterns and internationality, and then to bring it to market maturity and implement it as an idea. Periodization is also important here. It makes no sense to think about analytics or AI if the data structures are still in chaos.

Can you run through a typical innovation case for the readers of Themenschmiede?

A company recently asked us how many employees, which competencies and structures the organization would need in the next five to seven years. To find an answer, you first need a good understanding of the status quo: What services are being provided? How many people are involved? What competencies do they have? What structures and leadership styles characterize the collaboration? Then it’s a matter of sketching out tomorrow and creating a projection for the range of services and business models in five years plus x. What skills will be relevant then? How is staff deployment likely to change against the backdrop of digitali-zation, growth and new work? In this way, the delta in the area of Human Resources and Ways of Work can then be described and a plan developed. The key here is that the more precisely the business models of the future can be described, the more purposefully a com-pany can drive forward HR development and position itself in the competition for specialists and managers. Everything stands and falls with the clarity I gain about my business models and value creation of tomorrow.

A final tip for the readers of the Themenschmiede?

The important questions for your business model may be so close at hand that they are overlooked in a flood of information and analysis. Next time you’re shopping in the super-market, ask yourself what you might not have in ten years anymore. For example, I think it’s important to think about the future of the frozen food segment in terms of energy produc-tion and costs. Companies in this market can only be advised to develop a plan B. History is full of examples of failed companies that did not see the forest for the trees. One of the most tragic cases is Kodak, as we all know. When digital technology was on the rise, the leadership of Kodak held on to analog photography and as a result, ruined the company. Ko-dak moments like this should be avoided to the best of our ability. To do so, however, an organization must be committed to the future.

We would love to hear from you.

Get in touch

We would love to hear from you.

Get in touch